Valkyrie

Valkyrie

A Stratis Sanctions Screening Service

A streamlined sanctions screening service designed to help businesses meet sanctions compliance requirements from screening and executive reporting to voluntary disclosures

Valkyrie – A Stratis Sanctions Screening Service

A Streamlined Sanctions Screening Service from Screening and Executive Reporting to Voluntary Disclosures

OFAC sanctions screening involves screening customers, counterparties, employees, vendors, transactions, etc. across multiple lists with individuals and entities being frequently added and removed. All US persons must comply with OFAC’s regulations.

While OFAC provides an online search tool for simple screening, vendors often provide exhaustive and expensive screening solutions. As the OFAC lists are updated, new business lines are launched or acquired, new foreign markets are opened, goods exported, or complying with ongoing bank and payment partner contractual responsibilities, screening gaps can form increasing the likelihood of violating OFAC’s regulations. Certain individual and entity populations may need to be screened or re-screened, preemptively or reactively, potential matches reviewed and dispositioned, documented, and exact matches reported, if applicable.

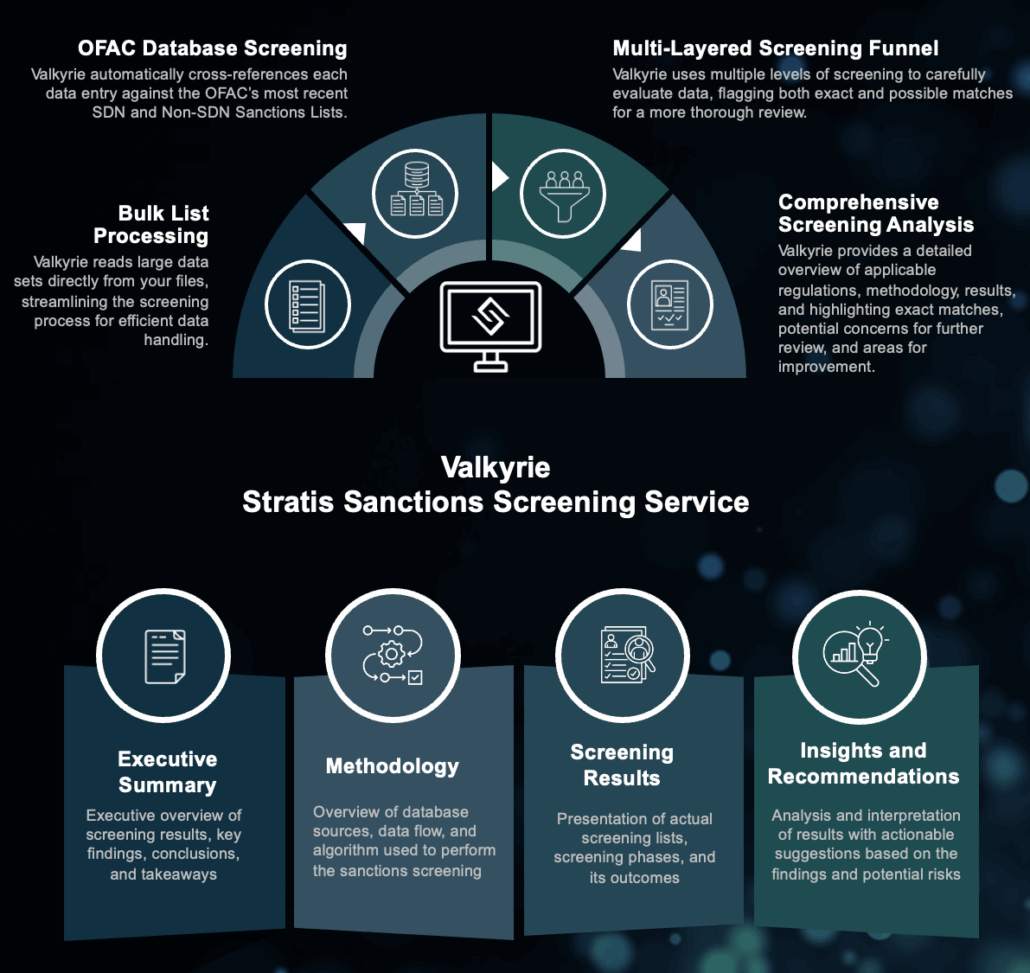

As a result, Stratis has developed Valkyrie, a streamlined sanctions screening service designed to help businesses meet sanctions compliance standards with ease, which includes screening, monitoring, dashboarding, and reporting. Stratis can help you with:

- Customer, vendor, and employee population screening and monitoring

- Subsidiary, affiliate, and foreign-located entity screening and monitoring

- Pre-and-post mergers and acquisitions due diligence screening

- Export clearance

For assistance with conducting OFAC sanctions screening using Valkyrie, contact us:

An OFAC Sanctions Compliance Program Mitigates Business Risk

Build a Scale-Appropriate Sanctions Compliance Program

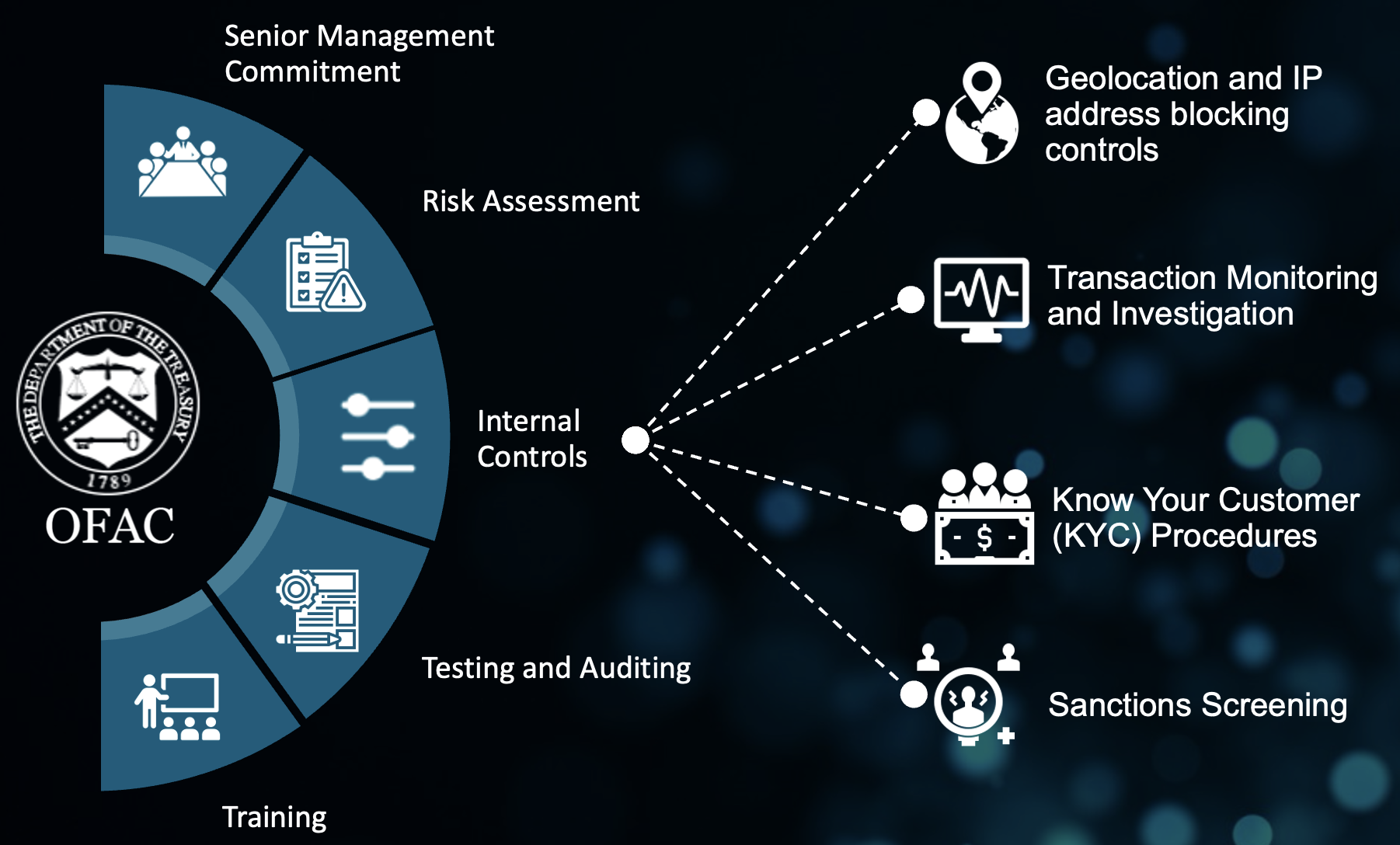

OFAC strongly encourages organizations subject to US jurisdiction, as well as foreign entities that conduct business in or with the US, US persons, or using US origin goods or services, to employ a risk-based approach to sanctions compliance by developing, implementing, and routinely updating a Sanctions compliance program (SCP).

While each risk-based SCP will vary depending on a variety of factors—including the company’s size and sophistication, products and services, customers and counterparties, and geographic locations—each program should be predicated on and incorporate at least five (5) essential components of compliance: (1) management commitment, (2) risk assessment, (3) internal controls, (4) testing and auditing, and (5) training.

Since the SCP guidance was issued in 2019, OFAC has identified in each public enforcement action that maintaining an SCP is considered a mitigating factor when determining penalties for non-compliance with sanctions laws and regulations. Moreover, OFAC subpoenas include documentation related to the five components of a SCP.

Long gone are the days where sanctions were considered historical embargoes and basic awareness of countries/regions to avoid doing business with. Company’s need to understand their sanctions risk, assess such risk, establish appropriate controls to mitigate the risk, train personnel, and include in company-wide testing processes.

For assistance with developing, scaling, or optimizing an OFAC sanctions compliance program, contact us:

2024 OFAC Sanctions Annual Report Reveals 100% Increase in Sanctions

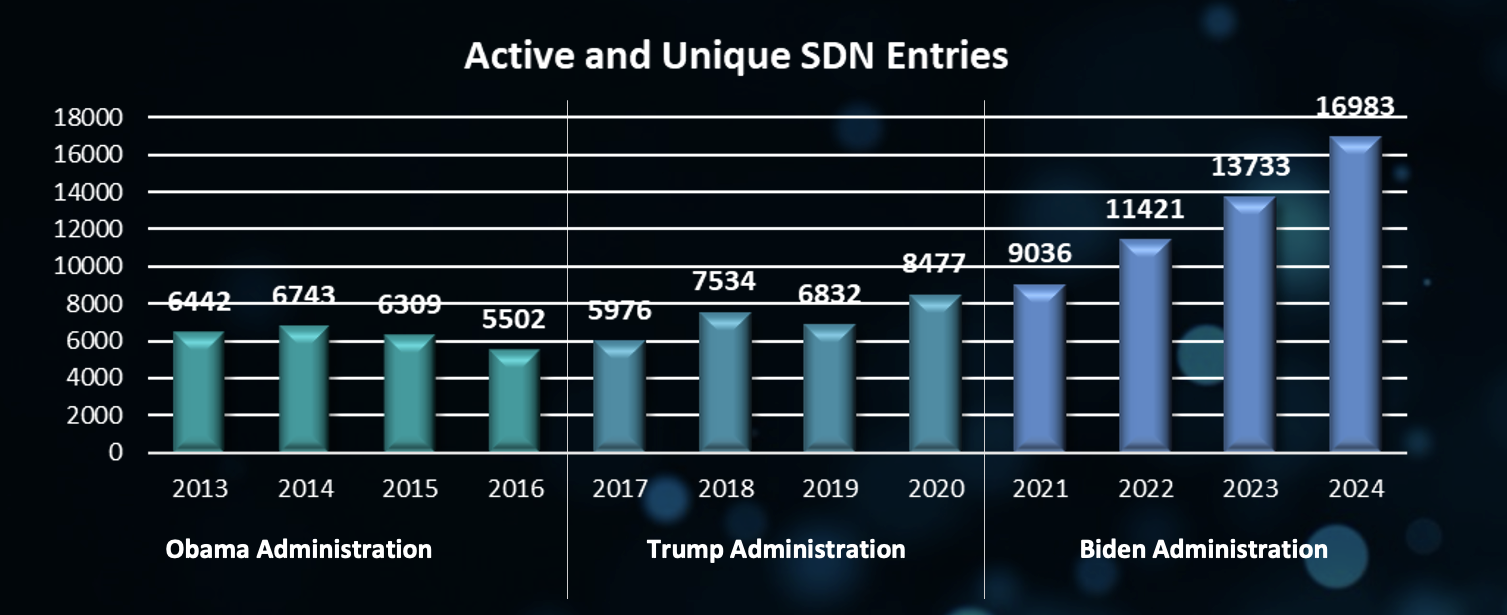

Biden-Issued OFAC Sanctions Increase 100% During Term

Each US President has faced various world events during their administration with President Biden as the sitting President during both the Russo-Ukrainian War of 2022 and Isreal-Hamas War of 2023. As a result, during President Biden’s term, sanctions increased almost 2,700 annually for an overall 100% increase over his four years.

In 2023, President Biden imposed secondary sanctions on foreign financial institutions (FFIs) under Executive Order (EO) 14114 if found to be involved with Russia’s military-industrial base. In 2024, President Biden further expanded secondary sanctions updating the definition of “Russia’s military-industrial base” and issuing revised guidance to address how FFIs can mitigate risks.

As a result, 2024 continued another year of unprecedented OFAC sanctions designations with more than 3,100 new designations on the SDN List and the highest ever total of nearly 17,000 entries.

Russo-Ukrainian War Sanctions Retain Top Billing

In 2024, sanctions on Russia reached an all-time high due to the ongoing Russo-Ukrainian War with more than 2,200 new additions, which represented almost 70% of the total designations, 279 sanctioned banks with banks located in Russia, which represented 56%, followed by Iran at 14% and North Korea at 9%, and digital currency addresses holding more $250 million USD with two addresses holding approximately 97% of the value.

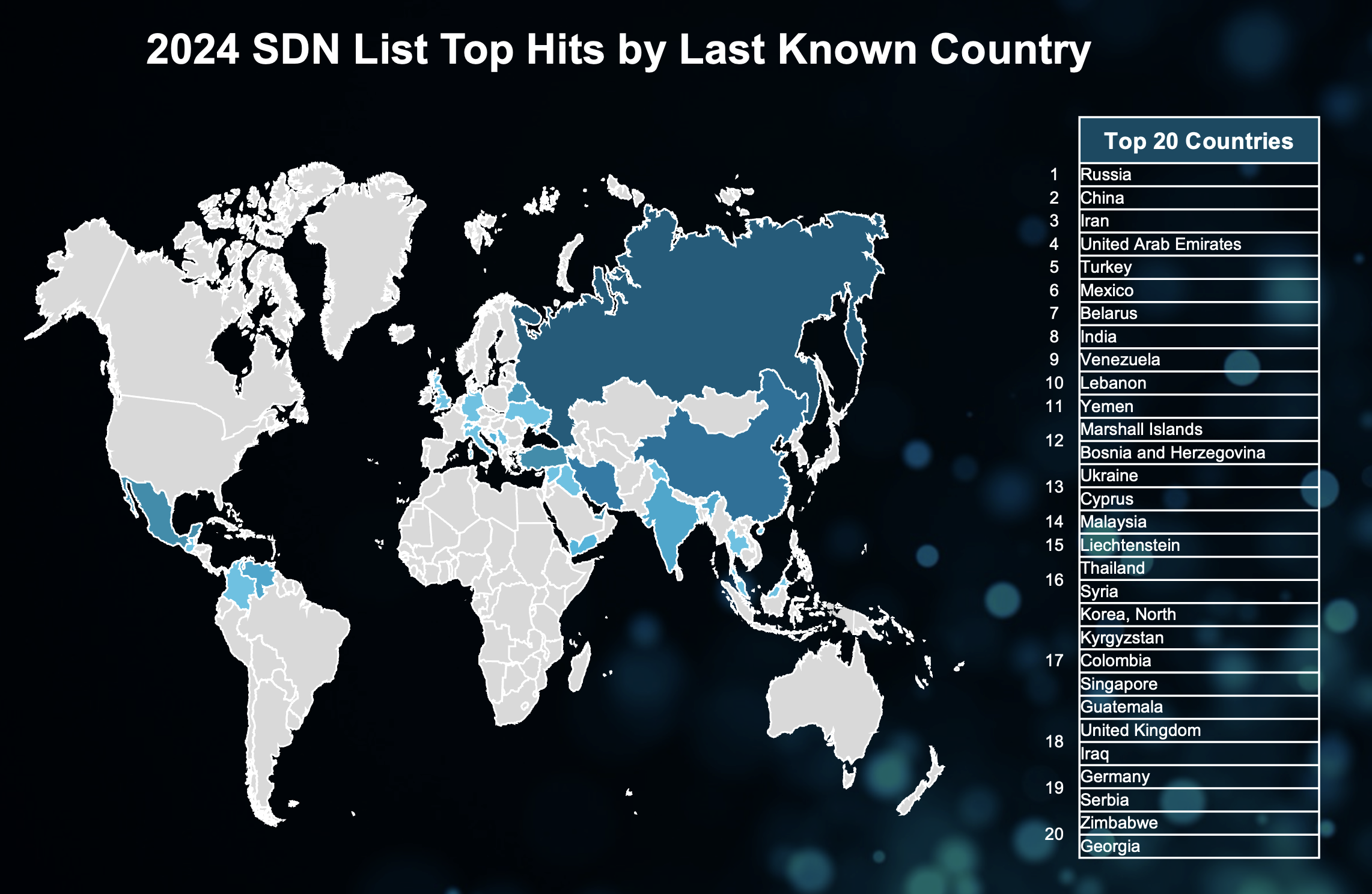

One of the key pieces of identifying information included on the SDN List are the names or aliases of sanctioned individuals, entities, as well as maritime vessels and aircrafts. Furthermore, personal information about designated individuals are also included in the SDN List, such as date of birth, address, identification numbers such as passport or social security information, and the last known country address.

For 2024, Russia, China, Iran, United Arab Emirates, and Turkey led the top 5 of the last known country where OFAC-designated individuals are believed to be located.

For more insight on OFAC sanctions programs, review our OFAC Sanctions Annual Reports:

OFAC Reporting Guides

OFAC encourages any individual or entity who may have violated US sanctions regulations to self-disclose apparent violations. Voluntary self-disclosures must include or to be submitted as a follow through within a reasonable period of time, which sufficiently provides a complete understanding of circumstances of the apparent violation/s.

OFAC requires covered persons or entities to fully comply with reporting obligations on blocked or unblocked property and rejected transactions. The initial reporting is required within 10 business days of the action or occurrence date with an Annual Report of Blocked Property (ARBP) to be filed by September 30.

AML AND SANCTIONS PROGRAMS

PART 504 CERTIFICATION | NEW YORK

All NYS DFS Covered Entities must establish and maintain transaction monitoring and OFAC sanctions watchlist filtering programs and are required to annually certify compliance by April 15 with Part 504.

415.352.1060 2193 Fillmore Street, Suite 1

San Francisco, CA 94115

RISK | STRATEGY | CYBER COMPLIANCE MANAGEMENT

© 2025 Stratis Advisory LLC. All Rights Reserved.

Terms of Use | Privacy Policy