Mergers & Acquisitions

Have you performed sufficient due diligence beyond the financials to understand your targets domestic and foreign operations?

Mergers and acquisitions (M&A) are run executing an old school playbook that only touches on the key surface areas and lacks insight into the underlying operations of the target. Stratis Advisory has an in-depth understanding of global regulatory markets where operations and systems are integral to operating a compliant organization. Having participated in multiple buy-side and sell-side due diligence and post-acquisition integrations, we can help you assess a target during your due diligence process to know what you are buying now vs. what you will be operating and integrating later.

Financial services-enabled companies operate under regulatory or embedded contractual requirements. Move beyond surface level due diligence, go deeper to know your exposure before you buy and the true operational cost post-acquisition.

Beyond the initial review of a target, a financial services-enabled company must have a multitude of controls and systems in place to maintain compliance. During the due diligence process, it is essential to understand the sufficiency of such systems in their current state and whether those systems can accommodate a new business, product, or company. Typically, this is an item pushed to post-acquisition, however, executing several additional steps in the due diligence process can bring to light the good, bad, and ugly of what be coming down the line that you will be 100% responsible for. Stratis Advisory can help you perform that next level of analysis during your due diligence process so you are better informed, can adjust pricing, and consider the state of risk and compliance programs in relation to regulatory and contractual expectations and requirements to avoid future regulatory impact such as penalties and consent orders.

Jumpstart your Acquisition Strategy by Assessing your Targets Operations

Operational and Regulatory Risk Drivers in Pre-M&A Decisions

Mergers involve the union of assets when two companies combine to form a new entity, whereas an acquisition is when one company absorbs another company. M&As are strategies for business growth that come with substantial risks. M&A among privately-held entities differs from transactions between a publicly traded company and a privately held entity.

M&A are transformative business transactions that require careful planning, thorough due diligence, and strict regulatory compliance to ensure success. In the US, M&A are regulated at both federal and state levels to ensure compliance with securities laws, antitrust regulations, and corporate governance standards. Public companies are subject to stringent disclosure requirements, shareholder scrutiny, and regulatory oversight to establish financial transparency and operation integrity.

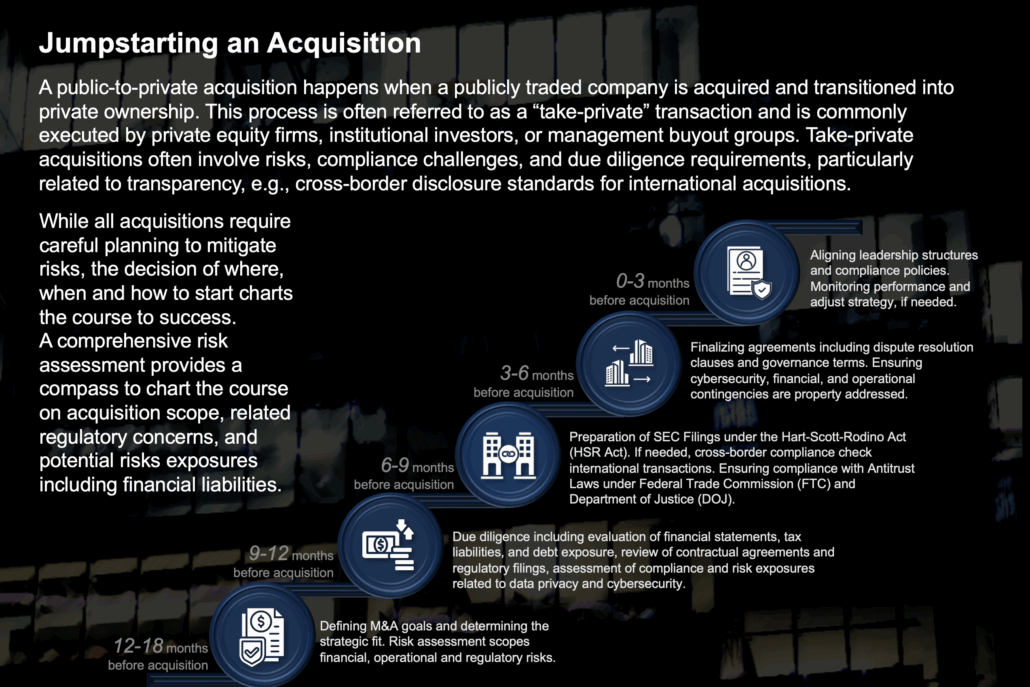

While all acquisitions require careful planning to mitigate risks, the decision of where, when and how to start charts the course to success. A comprehensive risk assessment provides a compass to chart the course on acquisition scope, related regulatory concerns, and potential risks exposures including financial liabilities.

Pre-and-Post Acquisition Risk Assessments Drive Operational Insight

Whether Targeting a US or Foreign Company, Understanding the Importance of a Risk Assessment in M&A Transactions

Risk assessments play a pivotal role in M&A transactions. Before an M&A transaction takes place, US companies must comply with regulatory requirements set by federal and state regulators. A comprehensive risk assessment ensures potential financial, regulatory, operational, legal, and technological challenges that could impact the transaction are uncovered and evaluated.

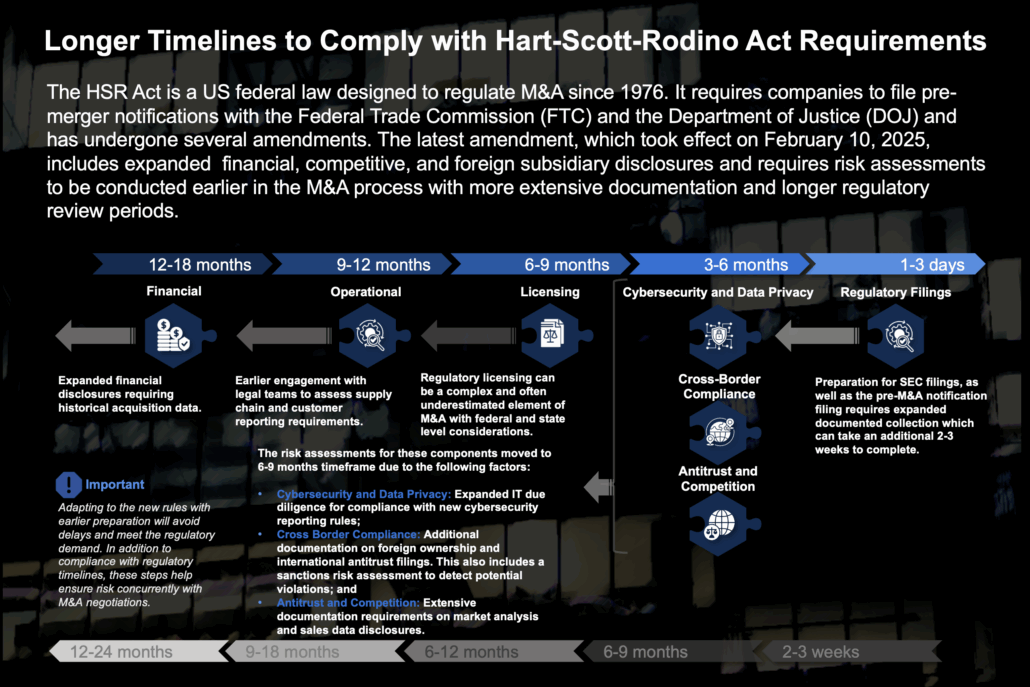

On February 10, 2025, the HSR Act, a US federal law designed to regulate M&A since 1976, was amended and requires companies to file pre-merger notifications with the Federal Trade Commission (FTC) and the Department of Justice (DOJ). The latest amendment includes expanded financial, competitive, and foreign subsidiary disclosures and requires risk assessments to be conducted earlier in the M&A process with more extensive documentation and longer regulatory review periods.

As US companies continue to expand globally, in the US, M&A activity with foreign entities is subject to strict compliance with national security, market competition, and financial transparency rules and regulations. Foreign M&A ownership structures and disclosures are also subject to global regulations outside of the US. Office of Foreign Assets Control (OFAC) sanctions screening is no longer just a cross-border concern, but a critical component to M&A risk management activities, which helps acquiring firms to avoid inheriting sanctions-related liabilities, penalties or asset freezes, and to establish strong corporate governance structure that is not exposed to sanctions risks.

Post-M&A Integration Processes and Operational Challenges

The Importance of Risk Mitigation in Post-M&A Integration Processess

Success post-M&A and foresight into opportunities and threats requires a competitive, continuous, and strategic risk management. While pre-M&A activities focus on strategic planning, risk assessment, and regulatory compliance, post-M&A efforts focus on ensuring operational efficiency, cultural alignment, financial stability, and assessing newly discovered pre-M&A unknowns.

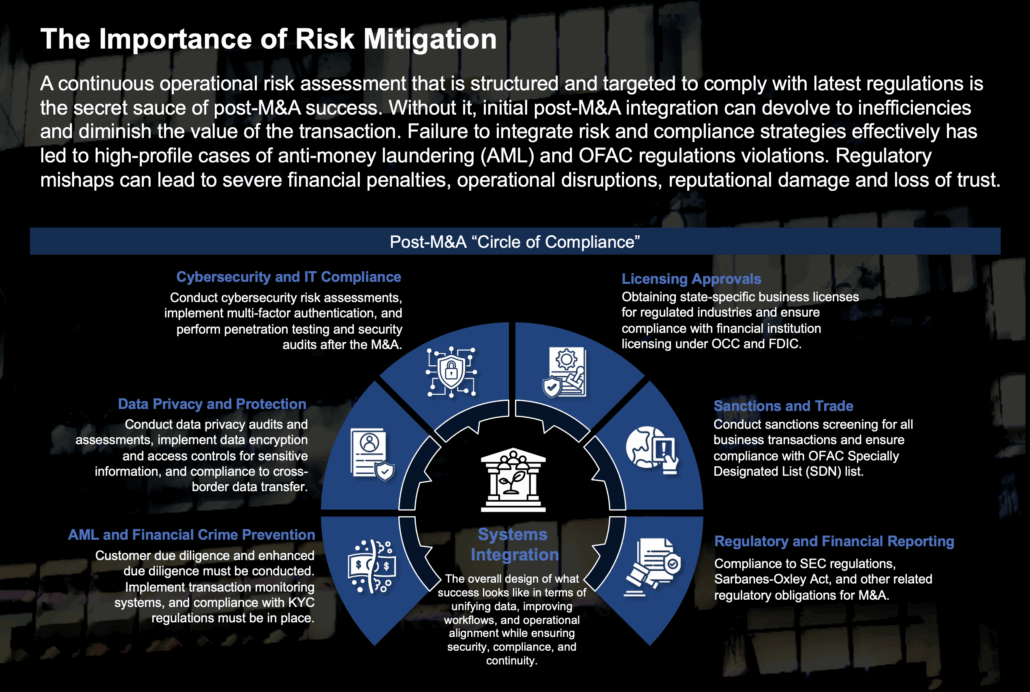

A continuous operational risk assessment that is structured and targeted to comply with latest regulations is the secret sauce of post-M&A success. Without it, initial post-M&A integration can devolve to inefficiencies and diminish the value of the transaction. Failure to integrate risk and compliance strategies effectively has led to high-profile cases of anti-money laundering (AML) and OFAC regulations violations. Regulatory mishaps can lead to severe financial penalties, operational disruptions, reputational damage, and loss of trust.

Post-M&A, systems integration must be embedded into the compliance structure of the new entity from day one. While it optimizes systems and processes post-M&A, when done well it helps to spot inherited risks early and reinforces an environment with proactive governance. The US DOJ recently announced a decision not to prosecute a private equity firm after it voluntarily disclosed sanctions and export control violations committed by a company it acquired. With OFAC sanctions reaching an all time high in 2024 after significant year over year increases during the Trump 45 and Biden administrations, the executive branch continues to leverage sanctions as a measure to influence foreign policy.

Adopting a structured, strategic approach that emphasizes on these priorities will ensure alignment with evolving legal and regulatory structures, which includes acting quickly to self-report potential violations. The key to gain leniency with a regulatory agency is establishing internal protocols for full cooperation with authorities, making witnesses reachable, sharing internal investigations findings, and fostering open communication. A disclosure decision framework that focuses on compliance is a vital component of any post-M&A systems integration frameworks from the start.

415.352.1060 2193 Fillmore Street, Suite 1

San Francisco, CA 94115

RISK | STRATEGY | CYBER COMPLIANCE MANAGEMENT

© 2025 Stratis Advisory LLC. All Rights Reserved.

Terms of Use | Privacy Policy